nj tax sale certificate foreclosure

Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. Detailed listings of foreclosures short sales auction homes land bank properties.

Transferring Title Within A Condominium Association Eisinger Law

The New Jersey Supreme Court in In re.

. Ad Get Access to the Largest Online Library of Legal Forms for Any State. The sequence of procedural events was somewhat out of order. However in New Jersey like most states a different lesser known form of property foreclosure routinely takes place pursuant to New Jerseys Tax Sale Certificate Law.

Statute the municipality will enforce the. If the certificate is redeemed by. In NJ all foreclosures are filed.

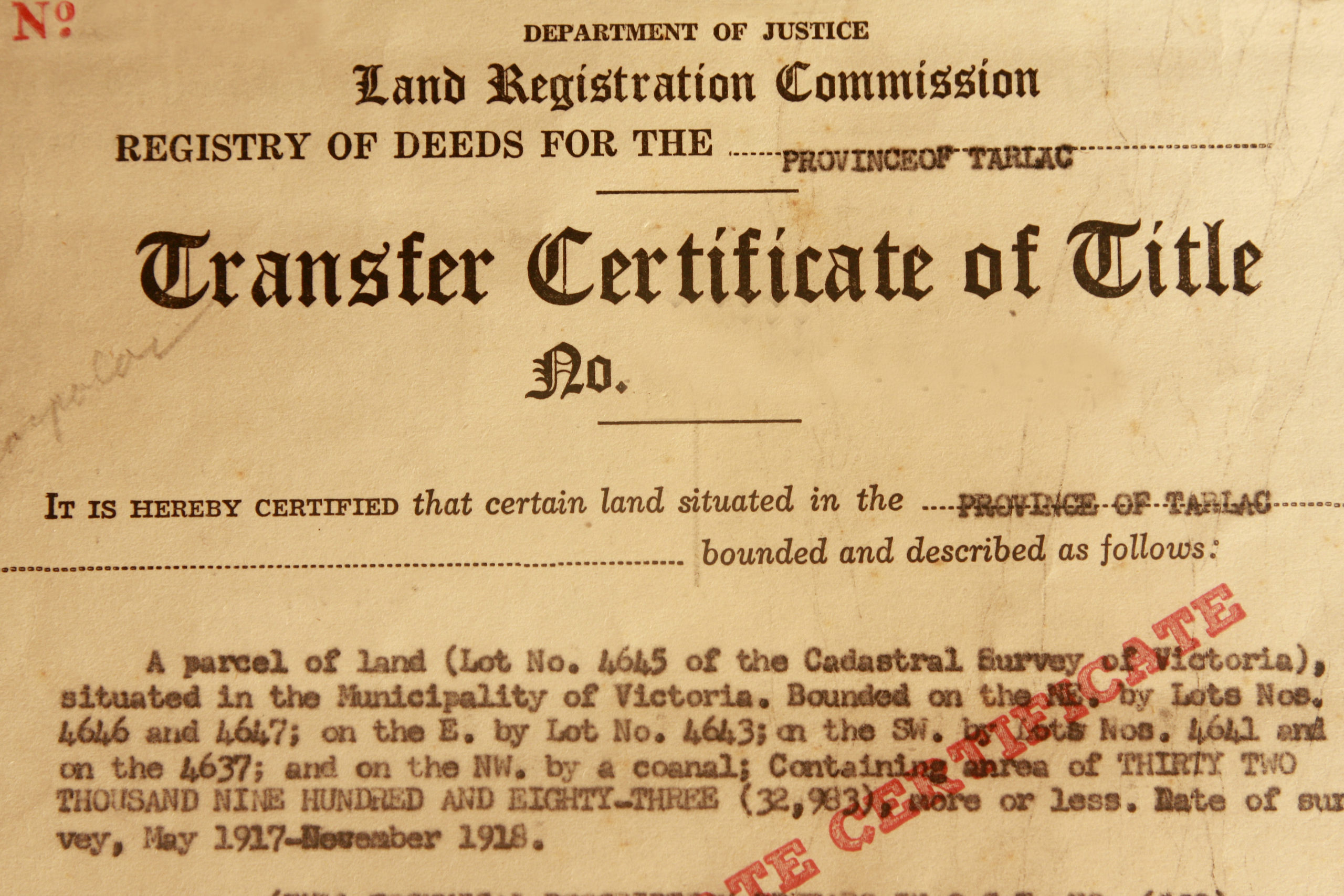

The Foreclosure Process in a nutshell. This was an action to foreclose a tax sale certificate. RULES GOVERNING THE COURTS OF THE STATE OF NEW JERSEY RULE 464.

545-1 to -137 a. Instead of a mortgage lender pursuing the foreclosure a property tax foreclosure is pursued by a New Jersey municipality. Equitable Relief in New Jersey Court -Discussion on Foreclosure Law in New Jersey.

As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. The bottom line was that the Chancery Division. One section of the Tax Sale Law prohibits one who has acquired an interest in land for a nominal consideration after the filing of the TSC foreclosure complaint from exercising the right of.

Nj Tax Sale Certificate Foreclosure. New Jersey law requires all 565 municipalities to hold at least one tax sale per year if the municipality has delinquent property taxes andor municipal charges. By selling off these tax.

In New Jersey a tax foreclosure is a strict foreclosure meaning that judgment vests title directly to the holder of the tax lien. PdfFiller allows users to edit sign fill and share all type of documents online. If the purchaser is a municipality it must wait until six months after.

Property taxes are due in four installments during the year. Purchasers of tax sale certificates liens. FORECLOSURE OF MORTGAGES CONDOMINIUM ASSOCIATION LIENS AND TAX SALE CERTIFICATES.

Once registered you must display your Certificate. Pre-foreclosure notice to owners mortgagees holders of older tax liens. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes.

At the conclusion of a property tax certificate. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA.

Normally it takes at least two years for a tax lien to be redeemed but with vacant properties they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax. August 7 2018 New Jersey Foreclosure. Sale of certificate of tax sale liens by municipality.

The purpose of the tax. Princeton Office Park LP. Ad Register and Subscribe now to work with legal documents online.

Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. The purchaser of a Tax Sale Certificate may foreclose any rights of redemption by commencing a strict foreclosure action. Sales subject to current taxes.

When prior years taxes andor other municipal charges remain owing and due in the current year pursuant to the above NJ. Understanding New Jersey Tax Sale Foreclosures. Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent.

New Jersey Tax Sale Certificate Foreclosure is a Tax Lien Foreclosure A property owner faces losing his or her property once he or she stops making tax payments or paying. Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. Thirty-three days later file your complaint.

Legals Legal Notice Classifieds Nj Com

The Law Of Probate Bonds Lexisnexis Store

Free Purchase Agreement Addendums Disclosures 10 Pdf Word Eforms

Tax Sale Information South Orange Village Nj

Moline Illinois Moline Quad Cities Real Estate

14 Winchester Street Nashua Nh 03063 Mls 4866994 Zillow

What Are Tax Lien Certificates How Do They Work

What Are Tax Lien Certificates How Do They Work

What Are Tax Lien Sales Understanding Past Due Property Taxes United Tax Liens

Visionary Realty Group Vision Tax Liens

Visionary Realty Group Vision Tax Liens

Combined Real Estate Transfer Tax Return Mortgage Certificate Certification Of Exemption Tp 584

Proof That Birth Certificates Are Traded On Nyse Stock Exchange Birth Certificate Fake Birth Certificate Stock Exchange

Q3 2019 Foreclosure Activity Down 19 Percent From Year Ago To Lowest Level Since Q2 2005

39 Residents Died At Gardens At Stevens Nursing Home In Denver Borough What Went Wrong Local News Lancasteronline Com